Market Commentary - Q3 2023

Below is an excerpt containing this quarter's market commentary. To download a copy of our full quarterly newsletter, click the Download Article link to the left.

The second quarter saw a continuation of the positive trend for stocks, while bonds delivered more muted results.

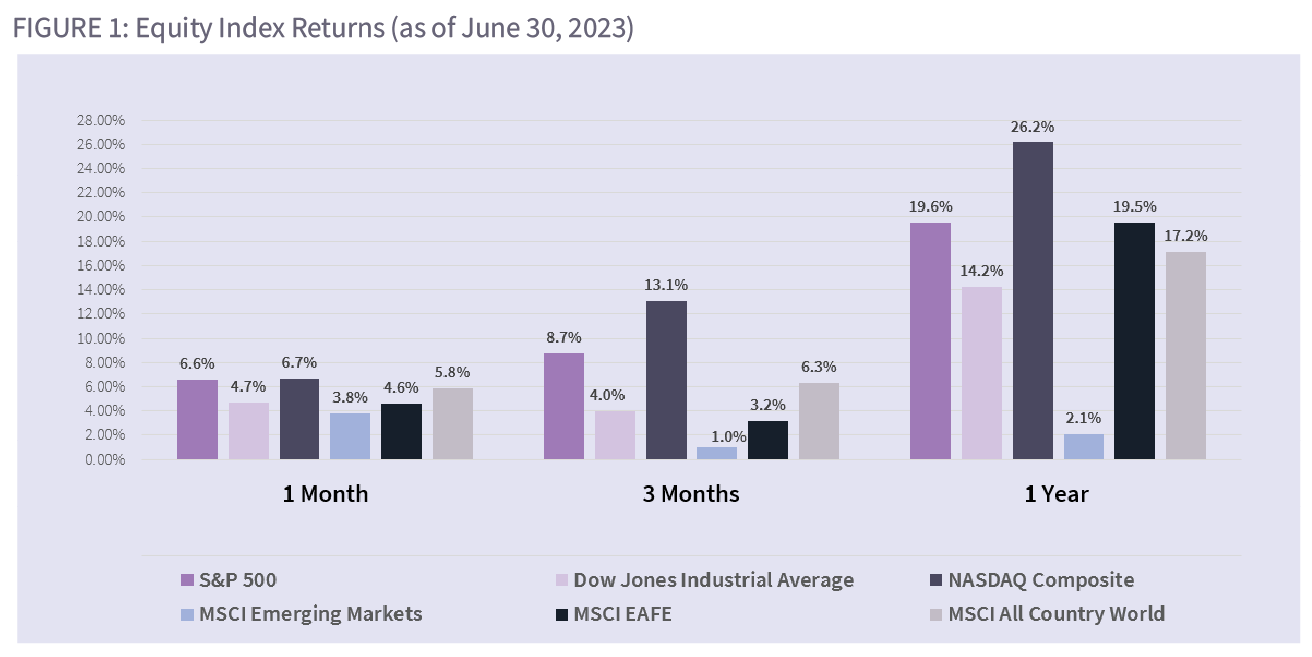

Over the past three months, the S&P 500, a broad index representing the performance of 500 large US companies, delivered a return of 8.7%. The Dow Jones Industrial Average, which tracks the performance of 30 major US companies, achieved a more modest return of 4.0% over the same three-month period. In contrast, the NASDAQ Composite, composed of technology and growth-oriented stocks, experienced a significant increase of 13.1% in the past three months, outperforming both the S&P 500 and the Dow. Looking at the one-year returns, the S&P 500 showed a notable gain of 19.6%. Similarly, the Dow Jones Industrial Average returned 14.2% over the same period.

In terms of international markets, the MSCI Emerging Markets index reported a return of 1.0% for the three-month period and a return of 2.1% for one year. The MSCI EAFE Index, which tracks the performance of developed markets outside of the US and Canada, returned 3.2% for three months and 19.5% for one year. Lastly, the MSCI All Country World Index, representing global equity markets, returned 6.3% for the three-month period and 17.2% for one year. (Fig 1.)

Overall, the stock market has shown positive returns across most asset classes, with technology-oriented indices outperforming broad market indices and international markets demonstrating mixed results.

One of the more significant events in the second quarter centers around the adoption of Generative Artificial Intelligence (AI). NVIDIA (NVDA), a leading technology company specializing in graphics processing units (GPUs) and AI, recently released its quarterly earnings report, which surpassed analyst expectations and delivered exceptional results. The company exceeded earnings estimates by nearly 19%, while revenue came in 10% above expectations.

NVDA's financial outperformance can be attributed to various factors. The company's GPUs have found wide applications in industries such as gaming, data centers, autonomous vehicles, and AI. With the increasing demand for high-performance computing, deep learning, and AI applications, NVDA has positioned itself as a key player in these rapidly growing markets. The stock certainly has benefited from this positioning, as it is up over 50% this quarter and over 180% YTD. Further, this earnings report has been a catalyst for other companies who are also well positioned to profit from the rapid adoption of AI (see inset). As leaders in this field, Microsoft, Google, Meta, and Amazon all stand to benefit from the massive productivity improvements inherent to this new technology. These stocks have also seen strong price performance ranging from 34% to 138% year-to-date.

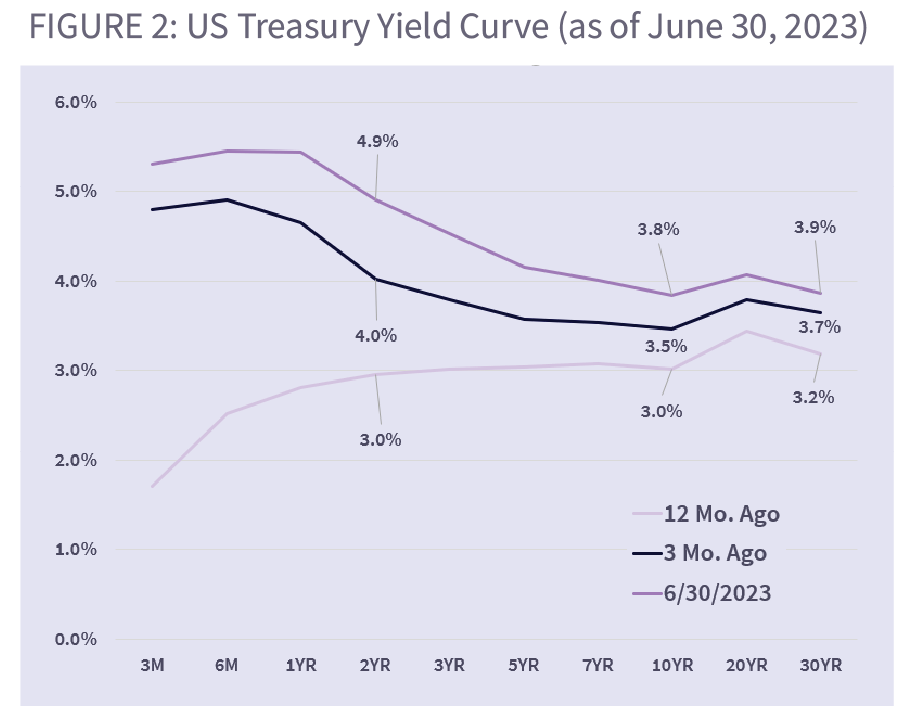

Turning to fixed income, Treasury yields experienced an overall increase as prices fell. Short-term yields saw the most significant rise, with Treasury bill rates reaching a peak of 6.02% on May 26th. Fears of a US Government debt default drove this unusual market action, as T-bill rates have not been this high in over 20 years. Since Congress passed a resolution on the debt ceiling, yields have fallen back to 5.14%. Longer-term Treasury yields also rose, reaching levels that are in line with year-end 2022 rates, after falling in the first quarter on fears of a recession (Fig. 2).

The rise in Treasury yields can be attributed to various factors, including changes in monetary policy, economic conditions, and investor sentiment. Higher yields generally indicate increased expectations of inflation and economic growth. All of this is consistent with recent economic data that has come in better than expected, particularly employment. As an example, at the end of April there were still over 10 million job openings in the US. While this number is off the peak of 11.5 million in March of 2022, it is still relatively high and above the 7 million job openings pre-pandemic (January 2020.) Despite employment being a lagging indicator of economic activity, this job market remains quite strong.

Another factor contributing to higher rates in the fixed income markets has been the Federal Reserve. A byproduct of the stronger economic data has been a reversal in expectations for future Fed action. In the first quarter of the year many (including us) thought that the regional banking crisis would stay the Fed’s hand. As the collateral damage from bank failures has remained limited, the Fed has continued the mantra of higher rates for longer, dashing hopes for a lasting pause or more imminent rate cuts. While the Fed did pause at their most recent June meeting, markets are now pricing in another hike in July. The Fed’s own “dot plot”, a graphical representation of potential future rate changes, is indicating two rate increases before year end. Those actions will be dependent on future data on inflation and economic activity, as Chairman Jerome Powell is fond of stating. And while the actual terminal rate may be a bit of a moving target, we do still believe we are very close to a peak.

Having now crossed the halfway point for the year, many of you may be wondering about the oft-mentioned recession that has yet to occur. Some strategists on the Street have pushed out their forecast for recession to 2024, given the relative strength still present in both the consumer and labor markets. The bond market is still indicating a potential recession based on the inverted shape of the yield curve, and the stock market is clearly more optimistic. Time will certainly tell which market is correct. Our base case remains a shallow recession late in 2023 or early 2024 or even a soft landing (where the Fed tames inflation without choking off economic growth.) In the meantime, we will continue to evaluate market events as they unfold. Please reach out if you would like to discuss your portfolio in more detail. Enjoy your summer! ■