Market Commentary - Q2 2025

Below is an excerpt containing this quarter's market commentary. To download a copy of our full quarterly newsletter, click the Download Article link to the left.

Q2 2025 Market Update: Stocks, Bonds, and the Art of the Comeback

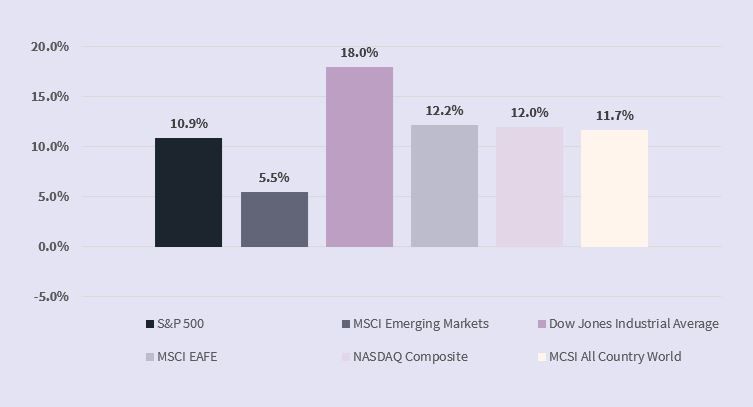

As we entered 2025, our main theme for markets was heightened volatility, while also acknowledging the market’s remarkable history of overcoming whatever the newest "wall of worry" might be. That balance of caution and confidence has proven well-placed. The first quarter offered its share of ups and downs, but the second quarter delivered a true loop-de-loop—at times unsettling yet ultimately rewarding for investors who remained patient and stayed the course (Figure 1).

Stock Market: From Tariff Tantrum to Tech Triumph

If you blinked in early April, you might have just missed the drama. President Trump shocked global markets with aggressive new tariffs which sent markets into turmoil, with the S&P 500 dropping more than 10% in a week. It did not take long for the administration to reverse course, pausing the tariffs and signaling a trade deal with China. The markets seemingly used that downward momentum to fly higher on the rollercoaster. From the April 8 lows, U.S. stocks climbed more than 25% in under two months, making this one of the fastest stock market recoveries in history.

As if that was not enough, markets also weathered a brief but intense conflict between Israel and Iran, which escalated to include U.S. involvement and a dramatic B-2 bombing mission. Oil prices spiked, then just as quickly retreated, and the market emerged largely unscathed.

Growth stocks that were the market darlings in 2023 and 2024 carried the market higher after they troughed in early April, led by strong first quarter financial results and continued optimism for widespread adoption of artificial intelligence.

International equities continue to remain resilient and continue to top the leaderboard in 2025 after they lagged U.S. equities for many years. 2025 continues to demonstrate the importance of maintaining diversified portfolios.

Fixed Income: Bonds, Yields, and the Waiting Game

Bond yields remained rangebound as investors weighed the competing forces of new tariffs, increased government spending, and the Federal Reserve’s next move. The impact of tariffs on inflation and global growth is fiercely debated. One camp believes tariffs will cause a one-time price hike, while the other warns of persistently higher inflation due to retaliatory tariffs and disrupted supply chains.

Our base case is for yields, especially on intermediate maturities, to remain in a tight range for now. We see some risk in long-duration bonds, as concerns about the long-term fiscal deficit could push investors to demand higher yields. Still, with the Bloomberg Aggregate Bond Index yielding around 4.7%, fixed income offers an attractive return. This high level of income provides a significant margin against principal fluctuation due to changing interest rates, thus adding to portfolio stability in these turbulent times.

Economics: Soft data vs hard data

The economy is sending mixed signals. While business and consumer surveys have weakened since the administration’s new trade policies, this softness has not yet shown up in the hard data. Inflation remains just above the Fed’s 2% target, and the labor market is still strong with the unemployment rate at 4.2%, though job growth is showing early signs of slowing.

The full impact of tariffs likely is not reflected in current data, as it takes time for higher import costs to reach consumers. We are watching this closely, as it could affect both stocks and bonds in the months ahead. The Fed is walking a tightrope, balancing the need to keep inflation in check with the desire to avoid choking off growth. If the labor market weakens further without higher inflation, the Fed may cut rates. But if inflation rises due to tariffs while employment stays strong, expect rates to remain higher for longer.

Gross domestic product (GDP) fell 0.5% in the first quarter, but that was largely due to companies accelerating their imports in anticipation of tariff increases. Second quarter GDP is expected to rise 2.5% according to the Atlanta Federal Reserve, as the absence of those imports pushes growth in the opposite direction. Accounting irregularities aside, both the U.S. and overall global GDP are expected to slow down in 2025 due to higher tariffs and ongoing trade and policy uncertainty.

Policy: Trade, Tariffs, and Fed Interest Rate Decisions

Trade policy remains front and center. The “One Big Beautiful Bill”—a major fiscal stimulus package— was signed into law on July 4th, 2025. This bill aims to provide further support for growth but also raises concerns about the long-term fiscal deficit and inflation.

Looking Ahead: What’s Next for Investors?

Inflation has moderated, but tariff uncertainties linger. The labor market is resilient, but cracks are beginning to show. Growth is likely to remain positive in 2025, though slower than in 2024. Markets remain expensive by historical standards, and the timing of Fed rate cuts is still uncertain given the central bank’s wait-and-see attitude.

Although timing is uncertain, the most likely path for the Federal Reserve’s next action is to lower rates, which would be stimulative for the economy. Meanwhile, fiscal policy is set to be highly stimulative, with a major spending package advancing in Washington. This dual dose of monetary and fiscal stimulus could support further gains in asset prices, but it also raises longer-term concerns about deficits and inflation.

This environment likely means continued choppiness for stocks through the rest of the year as the probable stimulus from both the monetary and fiscal policy compete with the potential headwinds from tariffs and trade. We continue to see value in bonds, which offer stable income and should help cushion portfolios if growth slows further. Diversification across geographies and asset classes remains your best defense.

Final Thought: Enjoy the Ride (But Keep Your Seatbelt On)

In summary, Q2 2025 was a reminder that riding out volatility by staying invested is the best strategy. The stock market proved once again that it can recover from just about anything—the key consideration of course being to stay in the market. The second quarter also demonstrated the benefits of diversification across geographies and asset classes. Fixed income offered a steady hand in a turbulent world, and the economy chugged along despite the noise.

While we do not expect a repeat of second quarter’s pronounced volatility, we do believe there is potential for more market surprises. Tariff negotiations are far from complete and the lack of strong consensus around the economy leaves the door open to shifting narratives. In the meantime, enjoy the ride as we continue to flirt with new highs in the stock market. ■