Market Commentary - Q1 2023

Below is an excerpt containing this quarter's market commentary. To download a copy of our full quarterly newsletter, click the Download Article link.

Money can be both a source of stability and a catalyst for the unexpected. While having a steady income can provide a sense of security and predictability, unexpected financial events can quickly upend even the most carefully laid plans. From sudden expenses like medical bills or car repairs, to unpredictable windfalls like inheritances or lottery winnings, the role of money in our lives is often intertwined with the unexpected. Moreover, unexpected economic events such as recessions or market crashes can have far-reaching consequences for individuals and society as a whole, reminding us of the inherent unpredictability of the global economy. Whether positive or negative, the unexpected impact of money can leave a lasting impression on our lives.

As we have written about recently, the month of March raised the specter of yet another unanticipated market event: systemic weakness in the banking system.With the collapse of Silicon Valley Bank and Signature Bank in the same weekend, depositors began to call into question the safety of their money.Panic was in the air as evidenced by the price of most bank stocks. The KBW Bank Index, comprised of 24 money-center and regional banks, declined 25% during the month of March.

Fortunately, there have been no further weekend closures of banks since these two failures occurred, although hurried deals for First Republic and Credit Suisse have demonstrated that SVB and Signature were not alone in their challenges.And while we don't expect contagion among more typical main street U.S. banking institutions, revenue and profit is likely to be hurt by a subset of the issues that brought down the aforementioned firms.

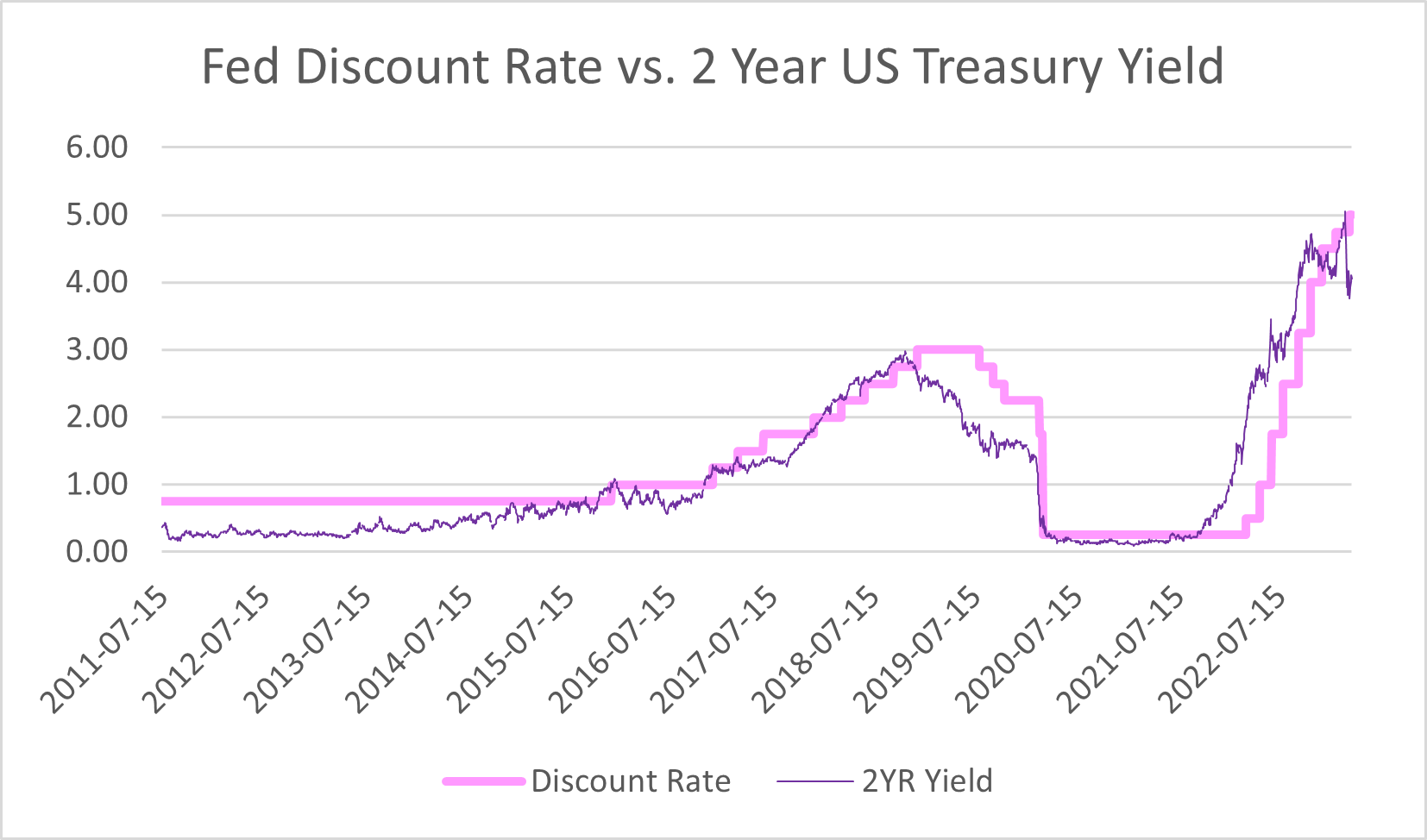

Ironically, one of the major factors impacting banks is the speed with which the Federal Reserve changed the interest rate landscape.A year ago, the Federal funds rate was 25 basis points.Today it is 4.88%.And despite the recent banking turmoil, the Fed moved forward with another 25 basis point hike at their March meeting, citing price stability as their primary concern.This may mark an inflection point for rate hikes, despite the fact that the Fed dot plot (a preview of potential future rate action) indicates there may be yet another 25 basis point increase on the table.

The two-year US Treasury note has a very good track record when it comes to predicting the future direction of Fed rate changes.On the Monday following the announcements around SVB and Signature, the two-year yield dropped a whopping 60 basis points (0.6%) in just one day.Today it is 1.21% below the peak in yield, 5.08%, set on March 8th.As can be seen in Fig.1 the two-year yield has historically led the actual Fed Funds rate and would indicate that we are very near a peak in rates and rate cuts may not be far off.

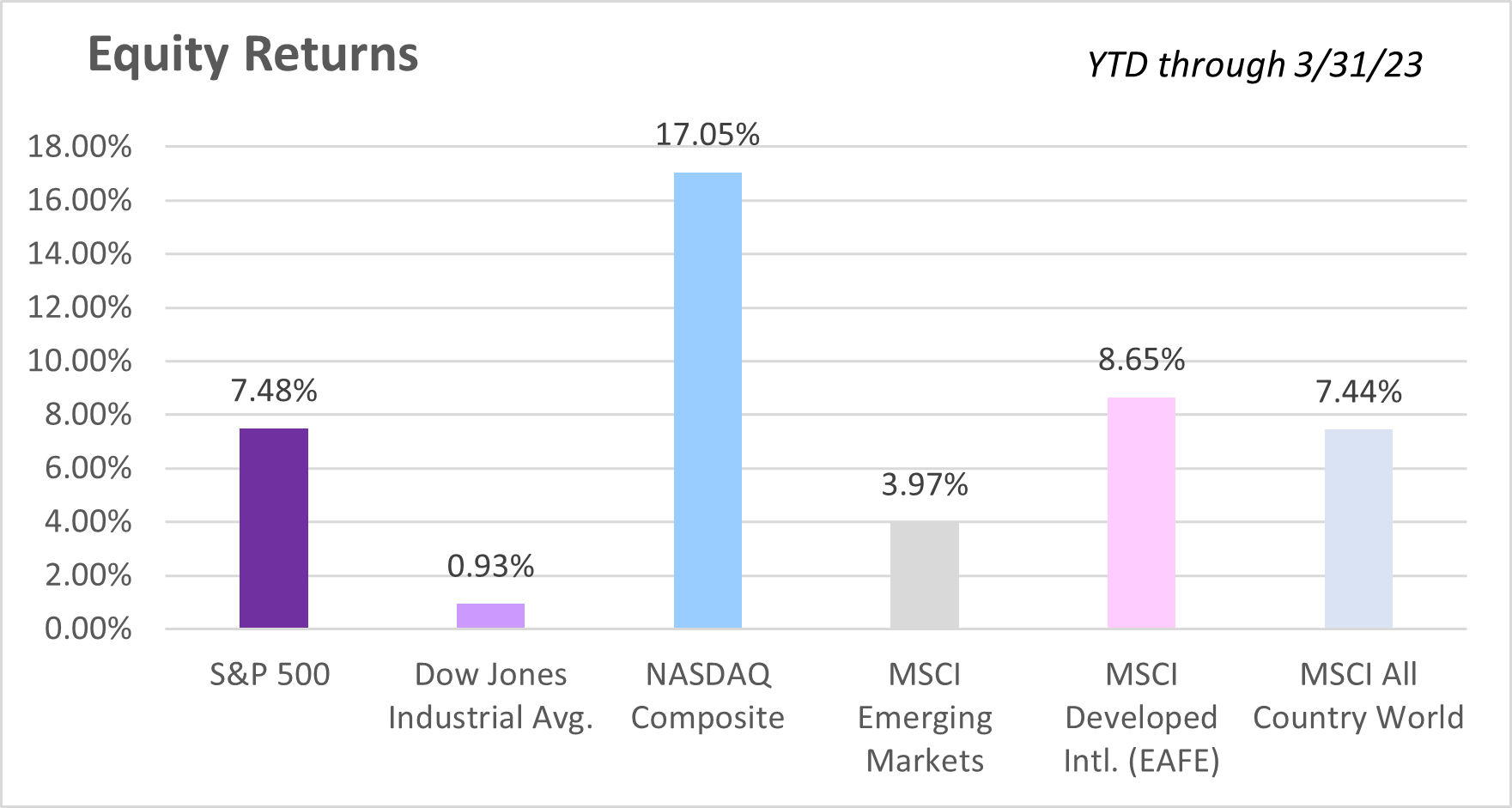

Turning to equity returns, it was a surprisingly strong quarter for stocks.Developed international led the broader indices higher, at 8.7% for the quarter.US Large Cap also posted strong returns at 7.48%.US Small Cap and Emerging Markets were the laggards, returning 2.5% and 4.0% respectively.When considering style, growth handily outperformed value in large and mid cap stocks, while value just slightly outperformed growth for small caps.This outperformance of growth can be seen in the stellar performance of the Nasdaq Index, which grew 17% for the quarter (Fig. 2).

The strength in stock performance can be attributed to a recent shift in expectations around future Fed action.The visible cracks in the banking system have lowered the likelihood of future tightening and perhaps also reduced the length of time that rates remain high.This recent change in narrative has been a boon for long duration growth stocks.

As we look forward our base case scenario for 2023 remains largely unchanged.The possibility of a recession in 2023 is still greater than 50%, and it is difficult to gauge if such a recession will be deep or shallow.The recent banking turmoil adds yet another unknown to what was already a murky picture.As previously mentioned both here and in other writings, we do not expect another financial crisis, but weak earnings and lower capital could contribute to tighter lending standards.

Equity returns are likely to continue to be range bound as investors parse data from earnings, jobs, inflation and Fed speak.Fixed income will likely be the beneficiary of a slowing economy and inflation that is trending lower.

As investment managers, it is our job to manage risk and return.As many of you know, we accomplish this through asset allocation.It involves dividing an investment portfolio among different asset classes, such as stocks, bonds, and cash, with the goal of achieving the highest return for a given level of risk.

In the context of managing stock market risk, asset allocation is particularly important because the stock market can be so unpredictable. By diversifying a portfolio across different asset classes, investors can reduce their exposure to market risk and potentially increase their returns.

At Birchbrook we implement asset allocation strategies in a number of ways.

Using a balanced portfolio: A balanced portfolio typically includes a mix of stocks, bonds, and cash, with the exact allocation depending on an investor's risk tolerance, time horizon and other investment goals.

Sector allocation: Another approach to asset allocation is to invest in different sectors of the stock market. This can help to spread risk across different industries, such as technology, healthcare, and energy, and reduce the impact of any single sector on the portfolio's overall performance.

Market capitalization allocation: Market capitalization is a measure of a company's size and is often used as a basis for categorizing stocks as large-cap, mid-cap, or small-cap. Allocating investments across different market capitalization categories can help to diversify the portfolio and reduce exposure to any single company or sector.

Geographic allocation: Investing in stocks from different geographic regions can also help to reduce risk. By investing in international markets, investors can diversify their portfolio across different economies and potentially benefit from different economic cycles and market trends.

Overall, asset allocation is a critical strategy for managing risk. In these uncertain times, it may not eliminate bumps in the road, but should reduce their impact.Should you like to review your goals and how they relate to your asset allocation please reach out.We look forward to speaking with you.