Market Perspectives - October 2024

Walking a Tightrope: Balancing Inflation, Growth, and Employment

Imagine walking a tightrope high above the ground, balancing carefully with each step, knowing that a misstep could send you off course. The finish seems so close, but the wind is picking up. The Federal Reserve (the Fed) is currently walking that tightrope, managing inflation and employment. On one end, barring a major geopolitical escalation that causes energy costs to rise, it appears that inflation is behind us. The Fed and the market have turned their focus to employment and growth. The unemployment rate rose from 3.4% to 4.1%, triggering the Sahm rule, a popular recession indicator. The rise in unemployment was met with the largest interest rate cut since 2020 as the Fed hopes to maintain balance and not fall off course. Investors cling to every economic data point and have reacted, and sometimes seemingly overreacted, as the market experienced heightened volatility in the third quarter. Yet, despite the turbulence, both equity and bond markets managed to end the quarter in positive territory. (See Figure 1)

The Federal Reserve’s Interest Rate Cut: What Does It Mean?

The Fed employs several tools to control monetary policy, primarily setting short-term interest rates and adjusting money supply by buying or selling bonds in the open market. Its two main goals are price stability and maximum employment. After the COVID-19 pandemic hit, unemployment rates skyrocketed as businesses closed their doors and laid off millions of employees. The Fed responded by cutting interest rates to zero and purchasing a variety of bonds to increase the money supply and ensure liquidity in the bond market. Simultaneously, the government issued trillions of dollars in debt to stimulate consumers and support struggling businesses. This massive stimulus, combined with loose monetary policy, led to inflation reaching its highest level in 2022 since the Paul Volcker era in the late 1970s and early 1980s.

To combat runaway inflation, the Fed began aggressively raising interest rates from zero in 2022 to 5.5% in 2023. They held rates steady in the range of 5.25%–5.50% from July 2023 until the recent September 2024 meeting, when they cut rates by 50 basis points to 4.75%–5.0%. Keeping rates at this high level for over a year helped bring inflation down to near the Fed’s 2% target, while unemployment edged up but remained historically low at 4.1%.

Job well done, though the work isn't finished. Despite the low unemployment rate, the recent rapid increase is alarming as it has risen from a cycle low of 3.4% to just over 4.1% in less than a year. Economist Claudia Sahm’s recession indicator, the Sahm Rule, states that whenever the unemployment rate increases by 50 basis points or more from its three-month moving average, a recession follows. The Sahm Rule has been triggered, yet many investors believe this time might be different. One reason is that the unemployment rate started from an unnaturally low 3.4%; another is the influx of millions of workers who have recently entered the job market.

Why Did the Fed Opt for a 50 Basis Points Cut?

The Fed’s decision to cut interest rates by 50 basis points, instead of the more typical 25 point cut, was strategic. Rate changes take time to show their impact on the economy, and by cutting 50 basis points, the Fed signaled its intention to support employment while avoiding market panic.

Had the Fed opted for a smaller cut, and unemployment worsened, a larger rate cut at the next meeting could have led to fears that the economy was rapidly deteriorating. By aligning rates more closely with bond market expectations, the Fed provides itself flexibility for future decisions, keeping the economy stable.

The Federal Reserve doesn't have the strongest track record in avoiding recessions, largely due to the lag effect of rate changes. When the Fed raises or cuts interest rates, it takes time for these adjustments to fully impact the economy because much of the debt in the U.S. is fixed rate. Just as it took time for the Fed to rein in inflation, it may require patience to stimulate the economy and prevent the unemployment rate from spiraling out of control.

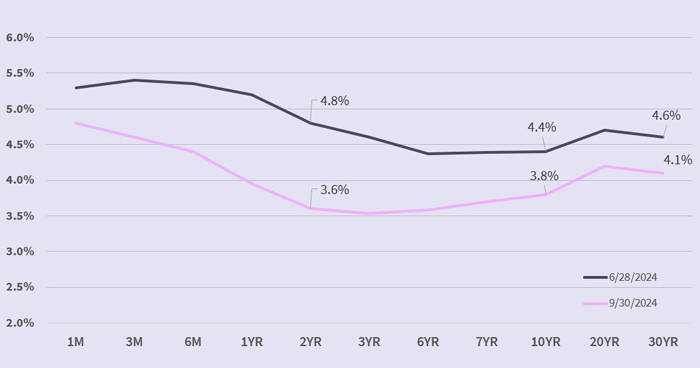

We believe the 50 basis point interest rate cut was warranted, as falling inflation and weakening employment pushed bond yields down during the third quarter, signaling to the Fed that the policy rate was too restrictive. (See Figure 2)

With the federal funds rate now more aligned with the bond market, unless a major geopolitical event spikes commodity prices, double digit inflation is largely behind us. The new priority should be emphasizing the full employment component of the Fed’s dual mandate. It's a delicate balancing act, and only time will tell if this strategy prevents a recession or if it is too little, too late.

Fourth Quarter Playbook

As we look ahead to the fourth quarter, we're paying close attention to employment because consumer spending drives the U.S. economy. Even though inflation has increased the cost of basic goods, wages have held up. The current unemployment rate of 4.1% is still historically low, but we will continue monitoring the labor market closely for any further changes. It will be critical for the employment landscape to remain healthy to avoid a downturn.

We expect the fourth quarter to remain volatile as we enter the election season. We recognize the delicate state of the U.S. economy and continue to position portfolios towards a conservative asset allocation. This stance acknowledges outsized market returns since 2023, historically high stock valuations, a weakening labor market, geopolitical risk, and domestic elections in November. We continue to favor global diversification and high-quality assets and are well prepared to take advantage of any market volatility to come.

Fixed income remains a critical part of client portfolios, offering high income, stability, and diversification, especially in a potential market downturn. We continue to believe high-quality bonds are reasonably valued and offer an attractive return relative to the risk.

Looking Ahead: Long-Term Focus, Short-Term Volatility

Ultimately, our goal is to anticipate market volatility and adjust your portfolios as economic conditions evolve. While markets have been choppy lately, remember that short-term disruptions are part of long-term investing. The goal of our strategy, focused on quality, diversification, and risk management, is to keep your portfolio on solid footing as we navigate this complex economic landscape. ■