Market Commentary - Q3 2025

Below is an excerpt containing this quarter's market commentary. To download a copy of our full quarterly newsletter, click the Download Article link to the left.

Market Commentary

Financial markets roared higher in the third quarter, with major indices around the world reaching new all-time highs. While technology stocks remain important drivers, leadership broadened meaningfully. U.S. small caps, represented by the Russell 2000, led with a 12.4% gain, followed by the S&P 500 (+8.1%), emerging markets (+10.9%), and developed international equities (+4.9%) (See Figure 1). These results extend a multi-year bull run in U.S. equities, powered by stimulative fiscal policy, AI-driven capital spending, and expectations for lower interest rates ahead. Still, even amid celebration, there are reasons for caution: valuations remain elevated, trade and tariff uncertainty persist, and geopolitical risks continue to linger.

Still, not all margin strength is created equal. Large-cap technology and communication services companies continue to drive much of the expansion, while cyclicals and consumer-facing sectors show more mixed results. The heavy capital spending cycle in artificial intelligence also adds complexity.

Recent long-dated agreements—including CoreWeave’s $14.2 billion cloud contract with Meta, OpenAI’s multi-year “Stargate” infrastructure partnership with Oracle (multi-hundred-billion scale), and a 10-gigawatt strategic pact with NVIDIA—underscore how capital-intensive this build-out is becoming. For now, markets appear to be granting tech firms a “grace period,” rewarding extraordinary spending as long as revenues and earnings continue to expand. Over time, however, investors will expect free-cash-flow growth to justify the enormous AI investments. The durability of today’s near-record margins will hinge on whether this investment cycle produces lasting productivity and profit gains.

Like prior technological revolutions, AI will likely experience a period of over-investment followed by digestion. Attempting to time that inflection point is nearly impossible. We believe the prudent approach is to stay diversified across sectors, geographies, and market caps, emphasizing durable business models, strong balance sheets, and the ability to adapt as innovation evolves.

For now, the S&P 500’s margins remain a powerful tailwind—near 20-year highs, they give large companies some room to absorb short-term shocks. But with capex demands rising and recent tariffs, maintaining this profitability into 2026 and beyond will require both operational efficiency and disciplined capital allocation.

Economy: Stable but slowing

The U.S. economy continues to show resilience, though signs of cooling are evident beneath the surface. After a negative GDP reading in Q1, driven largely by businesses pulling forward imports, Q2 GDP rebounded sharply to 3.8%, well above economists’ initial expectations. The Atlanta Federal Reserve currently forecasts Q3 GDP at the same 3.8% pace, suggesting momentum has held up.

The labor market, however, is softening. Unemployment ticked up 0.2% in Q3 to 4.3%. While that level is still

historically low, the quality of job growth has weakened. The three-month average of nonfarm payroll gains fell to roughly 29,000 jobs per month, a steep decline from last year’s pace. Stricter immigration policies have tightened labor supply, muting the rise in the unemployment rate but amplifying the slowdown in hiring.

Against this backdrop, the Federal Reserve opted to cut interest rates for the first time this year in September. Even though inflation remains modestly above the Fed’s 2% target, policymakers judged that risks from a weakening labor market outweighed the threat of reigniting price pressures. Monetary easing now complements ongoing fiscal support, a mix that has historically extended, albeit sometimes complicated, late-cycle expansions.

Fiscal Policy, Taxes, and Deregulation

Fiscal policy remains stimulative for risk assets as the Government continues to run a large fiscal deficit. The “One Big Beautiful Bill” extended key TCJA tax cuts and added new reductions including untaxed tips and overtime, a higher SALT cap, larger standard deduction and child tax credit, and a senior deduction that is retroactive to January 2025. These changes will likely have minimal impact on growth in 2025, but early 2026 tax refunds should provide additional stimulus to consumers.

Potential deregulation could shape both markets and the broader economy in the coming years. Looser rules in sectors like energy, financials, and technology may cut costs and boost profits, while also encouraging investment and job growth. For the economy overall, deregulation could spur productivity and capital spending, but it also risks creating imbalances if safeguards are weakened. The challenge for investors is to weigh short-term sector benefits against longer term stability.

Fixed Income

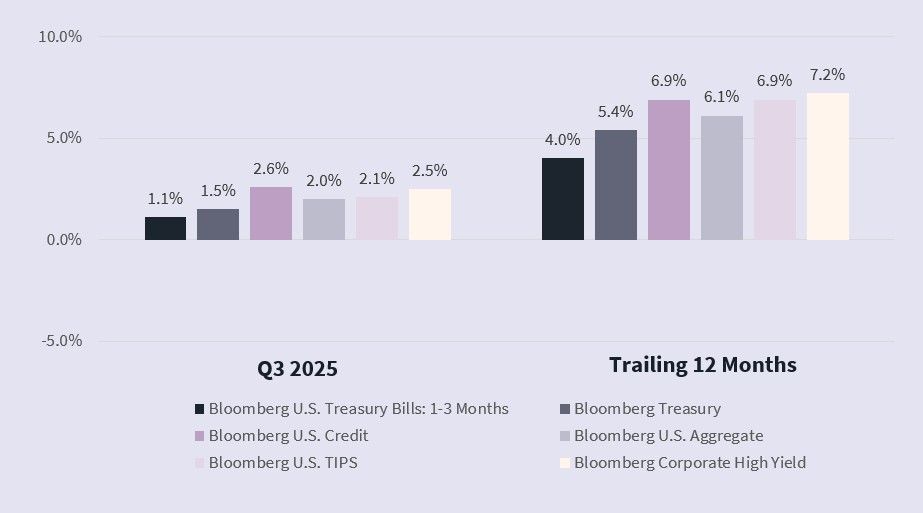

The bond market continued to provide stability and meaningful income. The Bloomberg U.S. Aggregate Index rose 2% in Q3 and is up 6.1% year-to-date, as yields declined across the curve (See Figure 2). Inflation has moderated, and a softer labor market helped push rates lower. We continue to expect yields are likely to remain rangebound through year-end. In this environment, strong starting yields continue to make bonds an attractive component of portfolios, offering both income and balance against potential equity volatility.

Earnings and Margins

While market valuations continue to rise and are quite high by historical standards, aggregate business fundamentals have largely been stronger than expected. Earnings momentum is healthy across most sectors, and S&P 500 profit margins are near two-decade highs, reflecting disciplined cost management, dominant high-margin business models, and the growing weight of technology within the index. Elevated profitability provides a cushion against slower revenue growth and tariff-related cost pressures.

Bottom Line

Q3 2025 marked another strong quarter for investors. Equity markets advanced on the strength of broadbased earnings growth, continued enthusiasm and investment in AI, and the Fed’s first rate cut of the year. Bonds also delivered meaningful income and stability, reaffirming their role as a reliable counterweight in portfolios.

While valuations remain elevated and policy uncertainty persists, the market’s foundation remains fairly solid, supported by strong corporate profits, steady economic growth, and continued progress on inflation toward the Fed’s 2% target. The combined effects of fiscal support and measured monetary easing have helped sustain demand while keeping financial conditions orderly. Looking ahead, the durability of this strength will hinge on the momentum in AI investment, the health of the labor market, resilient earnings growth, and stable labor market and GDP trends—factors that together will determine whether this expansion can extend into 2026 without overheating or stalling.

Our core guidance remains unchanged: stay invested, globally diversified, and focused on quality. As we saw earlier this year, periods of volatility should generally be viewed as opportunities to rebalance portfolios, not reasons to retreat. We appreciate your continued trust and partnership, and we remain committed to navigating the months ahead with the same discipline, perspective, and long-term focus that define our approach. ■