Market Commentary - Q2 2022

Below is an excerpt containing this quarter's market commentary. To download a copy of our full quarterly newsletter, click the Download Article link.

The French author and winner of the 1947 Nobel Prize in Literature, Andre Gide, once wrote: “One does not discover new lands without consenting to lose sight of the shore for a very long time.” Much the same could be said about investing. Volatility and uncertainty are a natural part of the investing process, and investors must agree to these risks if they hope to earn a return over time. Though markets tend to follow a course toward new highs over the long run, there will always be periods of turbulence that rock the boat and make investors uneasy along the way. Now is one of those uneasy times.

After years of relatively smooth sailing during which portfolios benefitted meaningfully, we’ve begun to encounter some chop. A combination of inflation, higher interest rates, geopolitical instability, COVID overhang, and elevated valuations has led to a prolonged period of market malaise. Both stocks and bonds have declined year to date, with the S&P 500 Index down 19.96% through June 30th and the Bloomberg Barclays U.S. Aggregate Bond Index down 10.35%. Rarely does the bond market decline in such close correlation with the stock market. In more normal times, bonds will increase in value as stocks fall, helping to blunt any pain. Because this hasn’t happened, an otherwise modest bear market has felt much worse than that.

Fortunately, there is good news to be had. Bonds have started to act a bit more bond-like in the past month, rallying off their lows as investors have sought safe havens. Going forward, absent any outsized changes in interest rate expectations, bonds should be more stable than they were in the first half of the year. For the first time in a long time, investors can earn a little bit of yield on their bond holdings, which increases their attractiveness and provides support for demand.

On the equity side of things, stock markets have been amazingly resilient. Despite an onslaught of disappointing news over the past few months, investors have refused to capitulate. Though stocks are down on the year, they remain higher than they were 18 months ago. Every time we see a period of meaningful declines, buyers step in to stem the tide and reverse markets upward. This is encouraging, and it calls into question whether we are truly in the midst of a bear market, and a mild one at that, or merely a severe correction.

If we are in a bear market, then it is reasonable to ask, how long and how bad can it get? Looking back throughout history, the average bear market has lasted about 12 months with a decline of roughly 35%. If past is prologue, then this would mean we’re about halfway through, with further declines to come. However, all is not lost. Dating back to 1957, there have been 12 bear markets. In 9 of those cases, returns were positive one year later, with the average return clocking in at 23.9%.

The news is even more optimistic for diversified investors. Looking at portfolios with a mixture of 60% stocks and 40% bonds, there have been 15 periods since 1945 where such portfolios declined by 10% or more, the present situation notwithstanding. In all such cases, returns were positive over the ensuing 12 months, and the average return was 18.4%.

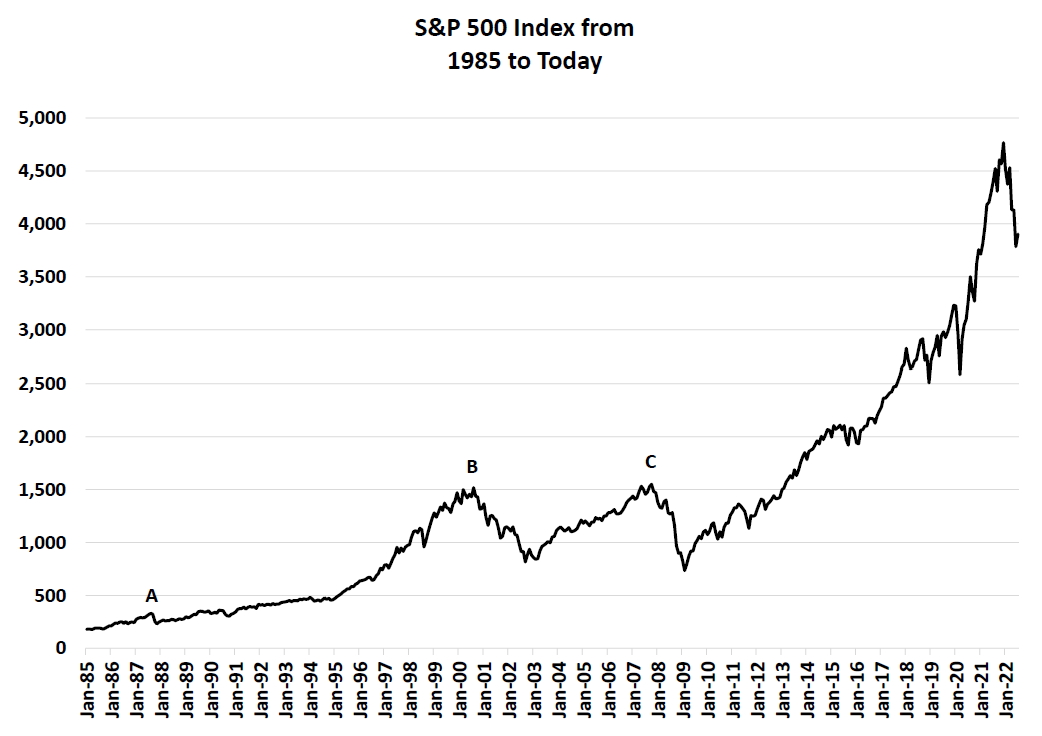

It is for these reasons that we always encourage clients to remain invested during periods of market volatility. One can never know exactly when a bear market will turn into a bull market, but missing that inflection point can seriously, and negatively, impact a person’s long-term investment returns. For context, take a look at the below chart:

First, imagine that none of your money was invested. Then, imagine you decided to invest all of your money at point A (Black Monday), or point B (Dot-Com Bubble Peak), or point C (Housing Bubble Peak). Even if your timing had been horrible and you had invested at the peak of each prior cycle, and even in spite of 2022’s market declines, you would have still made a handsome return through today simply by staying invested and trusting in the long-term behavior of markets.

Knowing this, and trusting in it, we have been cautiously opportunistic on behalf of clients. When appropriate, we have rebalanced to take advantage of lower prices. We have also made tactical adjustments to better position our equity and fixed income holdings in the face of heightened volatility and rising interest rates. Because the structural and geopolitical issues underpinning today’s volatility are likely to continue into the second half of the year, we expect to continue with these types of adjustments in the months ahead. Of course, we are always mindful of the impact of trading on client accounts. Be assured that, even though trading activity might be a little elevated this year by comparison with more sleepy periods, each trade we place is purposeful. As a result of our actions, we have been able to limit losses in fixed income portfolios and add value in areas like small cap and emerging market equities. On the whole, client accounts have held up better this year than a blended benchmark of bonds and global equities, and portfolios are positioned to benefit when sentiment turns around and markets advance in earnest.

To close, we cannot know the future with certainty. However, we can rely on history, past experience, inference, and probability to make reasonable guesses about what the future might bring. In the very short term, markets are likely to be buffeted by the economy, inflation, the Federal Reserve, the war in Ukraine, and other top-of-mind issues. Looking further out, however, we expect markets to be just fine. Thus, we view any dips from here as further buying opportunities as the market makes its way toward new shores.

Until next time, may you have an enjoyable summer.